Many of us feel like we are at the mercy of fate when it comes to our finances. We work hard but seem to never quite get ahead. We may wonder why it is that others can seemingly manage their money well while we struggle month after month. The truth is that taking control of your money is one of the most important things you can do for your financial future.

In this article, we will discuss some of the reasons why it matters to take control of your money and how you can go about doing it.

What Is Financial Control and Why Does It Matter?

Financial control is the ability to make decisions about your money that work for you. When you have financial control, you can make choices that improve your life and reach your goals. It also gives you the power to choose what is important to you and how to use your resources.

There are many reasons why having financial control matters. For example, when you have control over your money:

-You can save for the future and reach your financial goals.

-You can better manage your debt and get out of debt faster.

-You can afford to live the life you want now and in retirement.

-You can make wise investments that grow your wealth.

How to Take Control of Your Money

You can do many things to take control of your money and improve your financial situation. Here are a few tips:

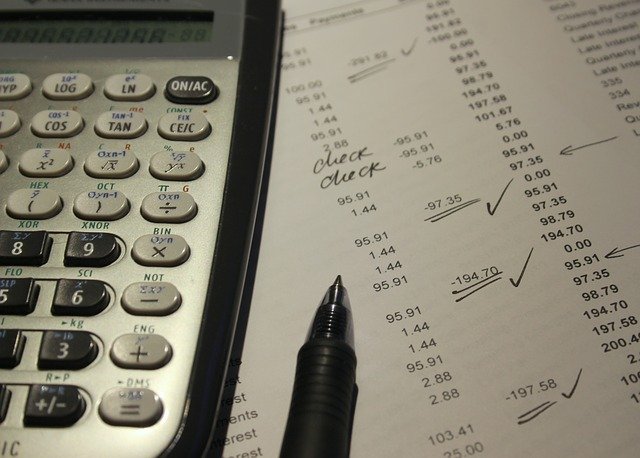

· Track your spending

If you know where your money is going, you can make better decisions about how to use it.

· Create a Budget and Stick to It

A budget helps you stay on track with your spending and reach your financial goals.

· Get Out of Debt

Debt can be a major obstacle to achieving financial control. Start by creating a plan to get rid of your debt as quickly as possible.

· Invest in Yourself

Education and training can help you make more money and achieve your financial goals faster.

The Importance of Creating a Budget

A budget is a plan for how you will use your money. When you create a budget, you decide how much money to spend on each category of expenses such as housing, food, and transportation. A budget also includes savings goals and debt reduction goals. You are more likely to reach your financial goals when you have a budget.

You have the power to take control of your money and achieve financial freedom. It won’t happen overnight, but starting today, you can make small changes that will add up over time. We hope this article has given you some ideas about where to start.